‘I almost quit school’: Students reflect on college loan struggles

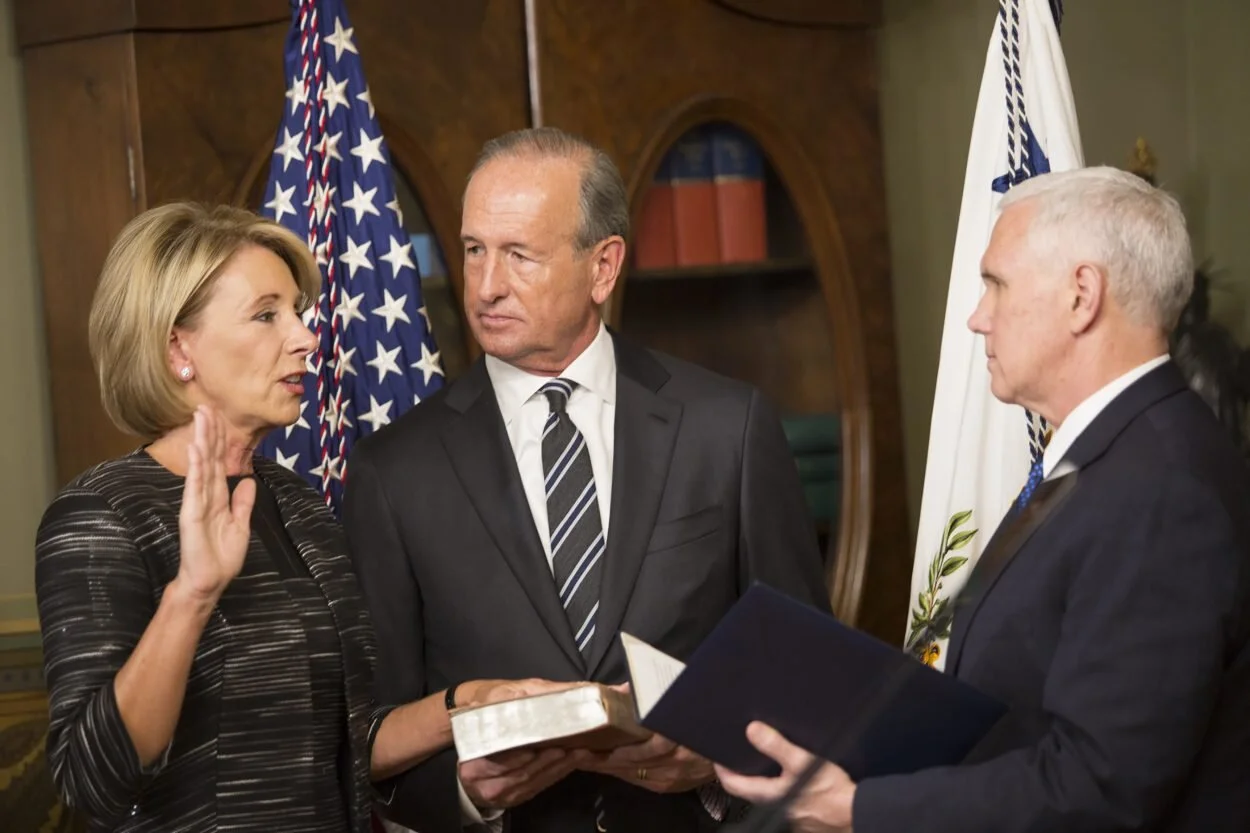

Vice President Mike Pence swears in Betsy DeVos as Secretary of Education as her husband, Dick DeVos looks on. 80,000 borrowers were victim to the Corinthian Colleges scandal due to Betsy DeVos’ order violation. WikiCommons

Students who once attended the Corinthian Colleges thought they would be protected by legislation condemning predatory lending; this did not stop United States Secretary of Education Betsy DeVos from violating an order to stop collecting loan payments for degrees the students never received.

On Oct. 24, DeVos was found in contempt of court and the United States Department of Education fined her $100,000 as it continued to collect loan payments from defrauded students despite Corinthian’s closing in 2014 due to predatory lending with deceitful data about future job opportunities. The students’ understanding was that their loans had been forgiven. Given DeVos’ collection of loan payments from defrauded students, the weight of student loan debt affects those using loans to attend Chapman.

“Student loan companies have a lot of room to take advantage (of students) but the bigger problem lies in the universities and the schools and how much they overcharge for things,” said Samantha Callaci, a junior screenwriting major.

While 45 million Americans are in student loan debt, the actual amount has reached over $1.6 trillion, according to the Federal Reserve Bank of St. Louis. 55 percent of Chapman students use federal student loans, leaving students with an average of $21,000 in federal debt after they graduate, according to College Scorecard. These figures don’t factor in loans from private loan companies or parent PLUS loans that students often use to pay the difference that federal loans do not cover. The Panther reached out to Chapman’s Office of Undergraduate Financial Aid for comment, but did not receive a response at the time of publication.

“There’s a lot of pressure to get the first job you can get (out of college) whether or not you like it or if it’s what you majored in,” Callaci said. “You tend to just stay there and that becomes your path because now you at least have a way to pay off your loans and have an apartment.”

Private loan servicers such as SallieMae, Navient and Mohela are a few of the many companies that provide student loans. Loan servicers act as the middleman between student borrowers and the colleges to which funds are dispersed.

“(SallieMae) gives me an amount I owe, but they don’t exactly tell me how they got that amount or what it’s for, so I don’t always know what I’m paying,” said Gabrielle Carlson, a sophomore business administration major. “It makes me skeptical of it all because they could be hiding something from me. I probably wouldn’t realize because I’m not the most educated on student loans.”

Navient, an offshoot of SallieMae, services 12 million accounts, according to Forbes. Both SallieMae and Navient have been sued on the charge that they cheated their borrowers of their repayment rights. Despite this, Callaci said that if it weren’t for SallieMae, she wouldn’t be at Chapman, as most of her tuition is covered by student loans. Although it gives her the opportunity to attend classes, the weight of the loans themselves almost made her leave Chapman.

“It made me almost quit school after freshman year. I’m a screenwriting student, but the degree doesn’t really guarantee you anything,” she said. “I have a lot of questioning and wondering if any of it is really worth it and often thinking about just quitting.”

Many students like Carlson find that understanding their loans is difficult. Economics and finance professor Gabriele Camera said that providing students with counseling regarding loans might help to manage the concerns.

“It would be helpful if universities had in place a program that helps students think backwards; a program would help them with what type of job they should have given the loan they have,” he said. “It’s like having a financial officer that helps you think through the future by starting from the future and moving back.”