Chapman University commits to divest from fossil fuels

The decision to divest reflects promises of addressing climate change and sustainability in the Chapman community. Graphic by HARRY LADA, Art Director

Chapman administration announced April 1 the university’s commitment to divest from fossil fuels, bringing resolution to a several-year-long battle between the institution and environmental activists in the community.

“The Endowment will not invest in direct securities of companies that are primarily engaged in the exploration or production of fossil fuels,” the revised policy states. “Additionally, the Investment Committee will not knowingly approve any new investments in private partnerships or commingled fun vehicles whose stated strategy and/or underlying investment primarily includes companies engaged in the exploration or production of fossil fuels.”

Janna Bersi, the vice president of investments and administration, told The Panther that since 2016, Chapman intentionally did not make any new investments in funds that focus on oil and gas production. In December 2021, Chapman leadership decided to stop investing in funds that are exposed to fossil fuels. This decision was approved by the Board of Trustees at its March 28, 2022 meeting.

“Due to the nature and structure of the endowment investments, as well as legal restrictions, it will take a few years for the minimal exposure to fossil fuels to wind down completely,” Bersi said. “Simultaneously, the Investment Committee has increased the endowment’s exposure to green energy investments.”

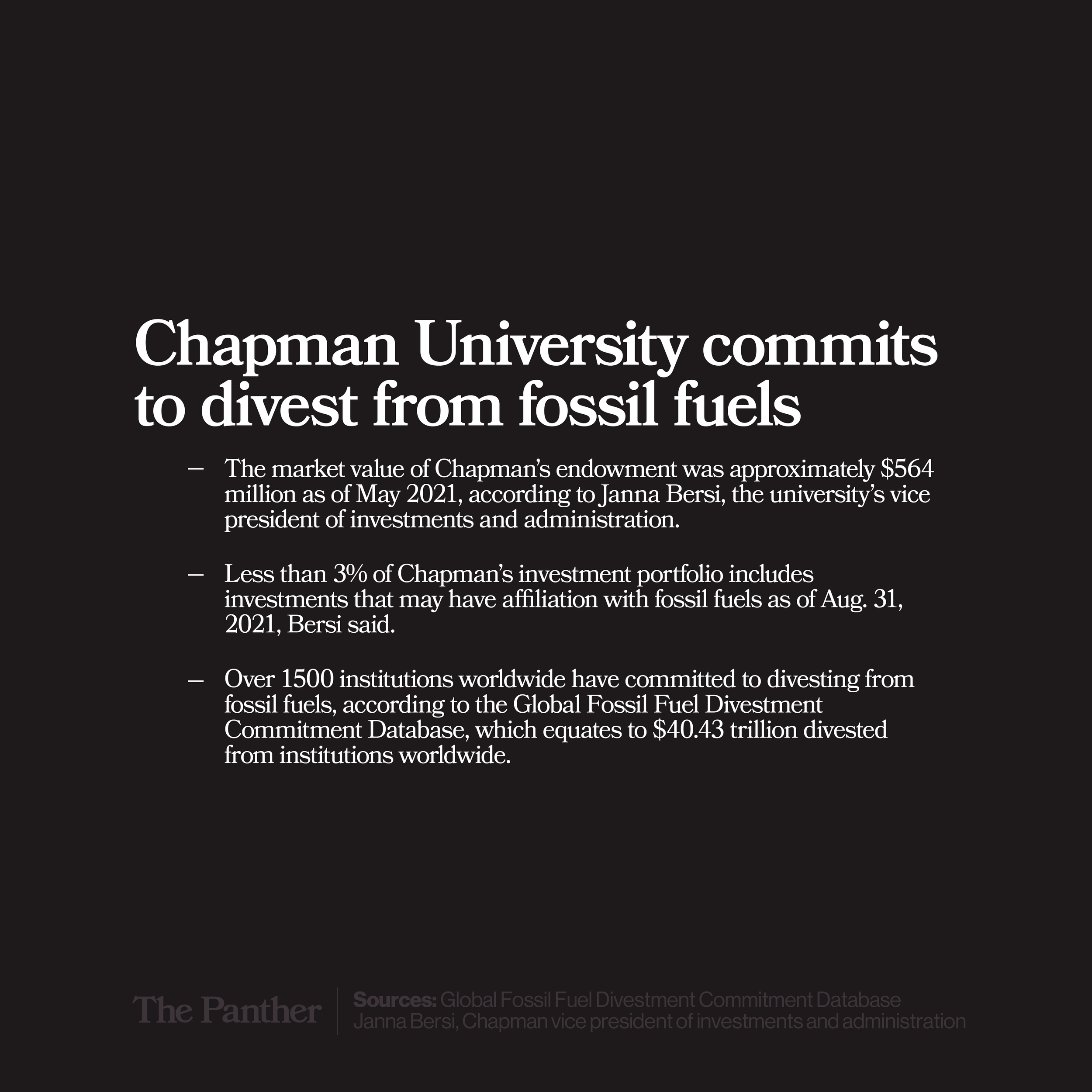

According to Bersi, as of May 31, 2021, the market value of Chapman’s endowment — assets invested by the university to support its education and research — was approximately $564 million. The endowment is made up of approximately 100 public and private funds, including commingled investments in domestic and international stocks, bonds, mutual funds, private equity, hedge funds, venture capital, real estate, cash equivalents and other investments.

“It is estimated that the total fossil fuel exposure has dropped to below 3% of the entire portfolio as of Aug. 31, 2021 and will continue to decrease,” Bersi said.

Divesting from fossil fuels has been an ongoing effort in the Chapman community, said Phillip Goodrich, president of the Student Government Association (SGA). The topic was addressed as recent as the March 8 SGA presidential debate, where candidates were asked by The Panther whether or not they support divestment.

“I want to highlight all of the community members that have been advocating for this for many years now,” Goodrich said. “There has been so much passionate and committed advocacy to make this big investment decision and now at long last it has paid off.”

In 2015, a group of Chapman students formed the club Fossil Free Chapman, which is no longer active at the university. The club ran a year-long campaign urging Chapman to divest, collecting 325 signatures. However, in 2016, the petition was dismissed by Chapman’s Executive Vice President and Chief Operating Officer Harold Hewitt.

Hewitt told the group it would not be realistic for Chapman to divest so much money, alleging that investing in fossil fuel companies financially benefits the university. After the dismissal of the petition, the club disbanded.

While the movement to divest from fossil fuels at Chapman stalled in 2016, other universities began taking drastic measures to divest.

The 20 largest college and university endowments in the U.S. total more than $322 billion and have been a key target of climate activists.

In 2020, the University of California (UC) system announced that it had divested completely from fossil fuels. The UC system sold more than $1 billion in fossil fuel assets from its pension, endowment and working capital pools, and it also invested $1 billion in clean energy projects.

In a statement, Richard Sherman, the chair of the UC Board of Regents' investments committee, said the divestment was reflective of a hopeful view of the future.

“As long-term investors, we believe the university and its stakeholders are much better served by investing in promising opportunities in the alternative energy field rather than gambling on oil and gas,” Richard Sherman, the chair of the UC Board of Regents’ Committee on Investments, said in a May 2020 statement.

C.K Magliola, director of Chapman’s women’s studies minor program, told The Panther that she is looking forward to seeing Chapman added to the list of institutions that have made the decision to divest from fossil fuels.

According to the Global Fossil Fuel Divestment Commitment Database, over 1,500 institutions worldwide have committed to divesting from fossil fuels, resulting in approximately $40.4 trillion divested.

“I am thrilled and relieved to no longer be working at a place that invests in fossil fuels,” Magliola said. “The board of any institution today choosing to take any other path is making a short-sighted, greedy and sadistic move.”

Addressing climate change and sustainability has been one of the primary goals of the SGA this year, Goodrich told The Panther. SGA members have worked closely with senior administration to implement university-wide practices and policies that combat climate change.

“An investment, like a budget, is a reflection of an institution's values,” Goodrich said. “Addressing sustainability is a holistic effort, but this is a big piece of the puzzle, and we are excited that it finally came to fruition.”

According to Bersi, investing in renewable energy is a priority for Chapman’s investment committee.

“In October 2020, the university made a substantial investment in a fund which focuses on the fast-growing greenfield renewable-energy sector, and particularly, the offshore wind market,” Bersi said. “In December 2021, the university made another investment in a carbon friendly fund which focuses on the California carbon market, which was designed to reduce annual greenhouse gas emissions while promoting price appreciation over time.”

Divesting from fossil fuels is just one piece of the larger puzzle of addressing climate change in the Chapman community.

“We’re going to continue engaging with these environmental issues and sustainability issues and topics,” Goodrich said. “We are very grateful that the university made this decision, and we are looking forward to working with them to continue this much needed effort.”