Analysis | 2024 California propositions: minimum wage, healthcare, rent, more

Graphic by Sukhman Sahota

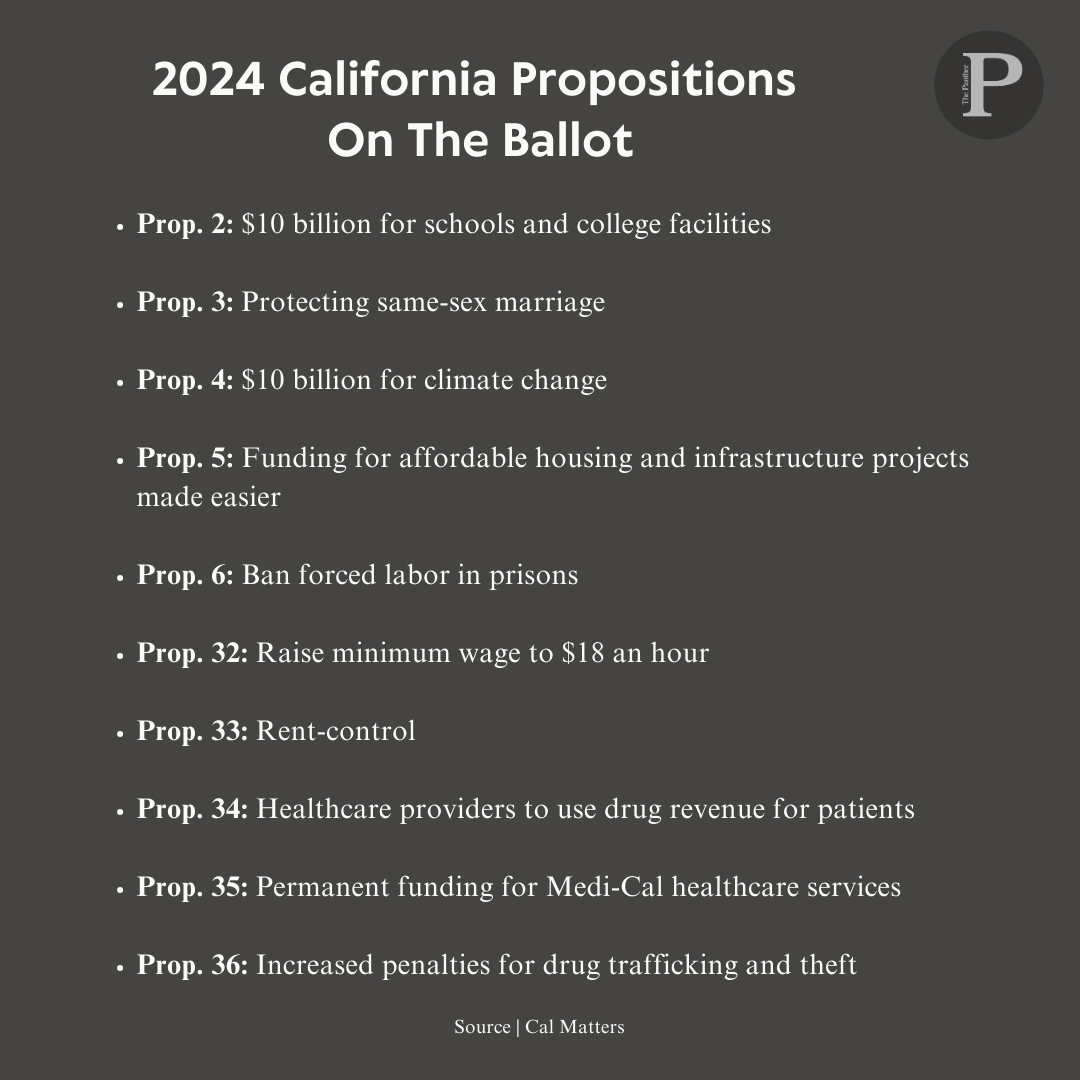

As the November elections approach, voters are deciding who they are going to vote for as the next president of the United States. Additionally to the presidential race and the high-stakes races for the U.S. House of Representatives, California also has 10 propositions on its statewide ballot that voters will get to weigh in on.

These ten measures will ask voters to decide if they support raising the minimum wage, banning forced labor in prisons, capping rent, protecting same-sex marriage and many more things.

Prop. 2: $10 billion for schools and college facilities

If Proposition 2 passed, it would provide $8.5 billion to K-12 schools and $1.5 billion to community colleges to renovate, fix and control facilities, which would be distributed through matching grants. Some of the money would also be set aside to remove lead from water, create transitional kindergarten classrooms and build career and technical education facilities.

According to the Public Policy Institute of California, 38% of students attend schools that fail to meet the safety standards of the state. Since California doesn’t pay for school repairs with a permanent funding stream, most money for that comes from state or local bonds. The last state bond, which proposed $15 billion of funding in 2020 and did not pass, which left California’s school repair account nearly empty.

While wealthy school districts have been able to raise money for repairs through local bonds due to the higher property values of their areas, lower-income districts have struggled to raise enough bonds, since it’s harder to pass local bonds in those districts, thus making them more reliant on state bond money.

This would cost the state an estimated $500 million per year over the next 35 years and would be paid with money from the General Fund, the account the state uses to pay for public services such as education, health care and prisons. In total, the cost would account for less than one-half of 1% of the state's total General Fund budget.

Prop. 3: Protecting same-sex marriage

If passed, Proposition 3 would amend the constitution of California to recognize the fundamental right to marry regardless of sex or race. This would repeal Proposition 8, which was passed in 2008 to ban same-sex marriage in the state by defining marriage as only between a man and a woman.

While Prop. 8 was effectively voided by the U.S. Supreme Court ruling that allowed same-sex marriage to resume in California in 2013 and the 2015 Obergefell v. Hodges ruling that legalized same-sex marriage in 2015, the language that limits marriage to being only between a man and a woman remains written into Californian Constitution.

Senator Scott Weiner and assembly member Evan Low introduced the constitutional amendment that added Prop. 3 to the ballot as a preventive measure to protect same-sex marriage in the state of California, citing the Supreme Court overturning of Roe v. Wade as the reason, as well as Justices Clarence Thomas and Samuel Alito’s criticism’s of the landmark ruling that the Supreme Court should reconsider the 2015 same-sex marriage ruling that legalized same-sex marriage.

Prop. 4: $10 billion for climate change

If passed, Proposition 4 would approve $10 billion in debt to spend on projects related to the environment and climate. The biggest chunk, comprising $3.8 billion, would go to water projects, half to improve the quality of drinking water and the remainder to protect from floods and droughts and restore rivers and lakes.

The rest of the money would be spent on other climate impact projects:

Wildfire and extreme heat project, $1.95 billion

Natural lands, parks and wildlife projects, $1.9 billion

Coastal lands, bays and ocean protection projects, $1.2 billion

Clan energy projects, $850 million

Agricultural projects, $300 million

The total cost to the state would be around $400 million per year for the next 40 years and the money to repay the bond would come out of the General Fund. The money would likely mean a decrease in local costs for environmental and climate projects, which could be funded through the state instead of with local bonds, as well as possibly reducing state and local costs to responding to and recovering from natural disasters.

Prop. 5: Funding for affordable housing and infrastructure projects made easier

Currently, California requires voter approval of at least two-thirds to pass city and county bonds, meaning that if local governments want to borrow money they need two-thirds of the vote to be approved.

Proposition 5 would lower the threshold for that approval from two-thirds to 55% of the vote to approve bonds for affordable housing construction, down payment assistance programs and other public infrastructure, which include water management, local hospitals, police stations, broadband networks and parks.

Prop. 5 also includes a ban on local governments using the borrowed money to buy single-family housing to convert them into affordable housing.

Prop. 5 would make it easier for local governments to fund “housing assistance” programs, which help low-income Californians afford housing, as well as acquire funds for public infrastructure.

Looking at recent trends, if Prop. 5 were to pass, between 20% and 50% more bonds would be passed, which would’ve raised a couple of billion dollars over many years. This would mean an increase in public infrastructure and affordable housing funding, but the costs would ultimately be paid with higher property taxes.

Prop. 6: Ban forced labor in prisons

Proposition 6 would amend the constitution of California to close the loophole that currently allows for involuntary servitude to continue as a form of punishment.

Currently, California’s 13th Amendment prohibits slavery and involuntary servitude, except if it’s used as a form of punishment for committing a crime. This loophole within the amendment that abolished slavery has enabled “modern-day slavery” and Prop. 6 is meant to close it to fully abolish slavery in the state.

If passed, forced labor would no longer be allowed in prisons and neither would punishment for those who refuse to work. Instead, the prop would allow incarcerated people to voluntarily work in exchange for getting time credit to reduce their sentences.

Prop. 32: Raise minimum wage to $18 an hour

Proposition 32 would raise California’s minimum wage from the current $16 to $17 for the remainder of 2024 and then to $18 starting Jan. 1, 2025. This measure would apply to any employer with 26 or more employees. For employers who have less than 26 employees, the minimum wage increase would be $17 starting Jan. 1 and then $18 an hour in 2026. After 2026, the minimum wage adjustment for inflation would return to the current rules, which increase the minimum wage every year based on the inflation in the U.S.

If Prop. 32 doesn’t pass, the minimum wage in 2025 in California would likely be $16.50, and in 2026 it would only increase to $17, instead of the proposed $18.

If passed, Prop. 32 would have many economic effects. Additionally, workers who work for minimum wage get paid more, there’s a high likelihood that the raise in the minimum wage would push up wages for other workers, meaning that many workers who are already working for more than $18 an hour would start making more money. However, higher wages would likely mean an increase in prices, as businesses would likely charge customers more to make up for the cost of the higher wages.

Prop. 33: Rent-control

If passed, Proposition 33 would repeal the Costa-Hawkins Rental Housing Act of 1995 to prohibit the state from limiting cities and counties from enacting, expanding or maintaining rent-control ordinances.

While California has several cities that limit how much landlords can raise rent each year, the Costa-Hawkins Rental Housing Act limits how much local rent control can do. Costa-Hawkins imposes three limitations on any local rent control law: rent control can’t apply to single-family homes, housing built after Feb. 1, 1995 and rent control can’t tell landlords what they can charge a new renter who is moving in for the first time, only how much they can raise rent for existing renters.

Currently, renters in California pay around 50% more than renters in other states. In California, renters spend an average of around 30% of their income on rent.

Prop. 33 would in and of itself not implement any rent control, it would just get rid of limitations cities and counties currently have when crafting rent-control laws. If passed, cities and counties would still need to take action to change their local laws.

Prop. 34: Healthcare providers to use drug revenue for patients

Proposition 34 would require healthcare providers who meet specific criteria to spend 98% of the revenue they make from the federal discount prescription drug program on direct patient care.

Currently, federal law gives healthcare providers a deal: in exchange for serving low-income and at-risk patients, they get a discount on pharmaceuticals. Providers that use that program can sell those discounted drugs at retail rates or provide their patients drugs for less cost and they can use the profit to expand their health services to disadvantaged groups, but there are currently no federal or state restrictions on how providers should spend that revenue.

While Prop. 34 would make it so providers have to spend 98% of the revenue from that program in direct patient care, this would not apply to all healthcare providers. Prop. 34 would only apply to providers that spend more than $100,000,000 within any 10-year period on anything that is not direct patient care and also operate multifamily housing that has had at least 500-severity health and safety violations reported. This means that for the proposition to apply to a provider they must own multifamily dwellings that have 500 or more high-severity health and safety issues that pose a risk to the tenants, such as severe mold or pest infestations, structural hazards, non-functioning plumbing, or other similar issues.

Due to those restrictions, if passed, Prop. 34 would only apply to the AIDS Healthcare Foundation. It is because of this that the prop has been criticized as targeting the AIDS Healthcare Foundation and its president, Michael Weinstein. Another factor that contributes to that criticism is that the main founder of this initiative is the California Apartment Association, an organization that is against Prop. 33. Prop. 33, like many other state policies for rent control and housing, was heavily pushed for and funded by the AIDS Healthcare Foundation.

Additionally, Prop. 34 would also permanently authorize the state to negotiate the Medi-Cal drug prices throughout the state.

Prop. 35: Permanent funding for Medi-Cal healthcare services

If passed, Proposition 35 would make California’s tax on health insurance plans, also known as managed care organizations (MCO) permanent, which is currently set to expire in 2026. This MCO tax package offsets spending from the General Fund for Medi-Cal by around $1 billion a year and the burden of the tax falls mostly on providers.

In addition to making the MCO tax permanent, Prop. 35 would require that revenues from the tax be used only for specified Medi-Cal services — primary and specialty care, emergency care, family planning, mental health and prescription drugs —- and for more of the revenue to be used to increase funding for Medi-Cal and other health programs.

Prop. 36: Increased penalties for drug trafficking and theft

Proposition 36 would change the charges for possession of certain drugs (such as fentanyl, heroin, cocaine or methamphetamine) and theft under $950 — if the person in question has two or more previous convictions for certain theft crimes — as from misdemeanors to felonies, as well as increase sentences for other specified drugs and thefts.

Prop. 36 would also create a new category of crime of “treatment-mandated felony,” which would allow people who plead guilty to felony drug possession to complete treatment instead of going to prison. This treatment would be something such as mental health treatment or drug treatment and upon completion, those convicted would have the charges dismissed. If the treatment is not completed, the person charged could face up to three years in prison.

In 2014, Proposition 47 was passed as a way to reduce overcrowding in California’s prisons, by reducing theft under $950 and possession of certain drugs to misdemeanors. Prop. 36 is an attempt to undo Prop. 47, as prosecutors, police and superstores blame Prop 47 for the increase in property crimes and homelessness.

While Prop. 36 increases the punishment for certain crimes, it also creates a new treatment-focused court process for drug possession charges, as well as warning people who are convicted of selling or providing illegal drugs that if they carry one and someone dies they could be charged with murder.

Prop. 36 would increase California’s criminal justice costs with the increase in prison population, as well as the increase in the workload of the state court. This increase could likely cost anywhere between several tens of millions of dollars to low hundreds of millions of dollars each year.

Additionally, it would raise the costs of local criminal justice courts by tens of millions of dollars each year, due to people spending more time in county jail or on community supervision, as well as an increase in the workload of local prosecutors and public defenders.

Not only would Prop. 36 increase the costs for the criminal justice system, but it would also reduce savings that are currently in place due to Prop. 47, which are meant to fund mental health and drug treatment programs, K-12 schools and victim services. Any savings that remain would be used for the new felony treatment program instead.