Analysis | Private schools: where Biden’s $10K loan forgiveness proposal falls short

Chapman first-generation students say that despite attending a private school, paying off student loans is an immense struggle. Graphic by HARRY LADA, Art Director

When Saira Ramirez first transferred to Chapman University in the fall of 2019, she found herself working as a full-time employee at T-Mobile, assisting her mother who was diagnosed with cancer, caring for her five siblings and juggling a packed class schedule. As the first person in her family to attend college, Ramirez is proud of her accomplishments, but admitted it took a while to find her footing.

Burdened by the demands of work and academic expectations, Ramirez ultimately decided to quit her job. Despite already being on a $5,000 transfer scholarship and accepting Cal Grants and a Federal Pell Grant, Ramirez invested the $20,000 from her 401(k) and sold her stocks in order to pay for her education.

“Even though we’re in a private school, that doesn't mean we are economically more empowered,” Ramirez said. “We are really struggling. Many of us decided to go to a private institute not because we have the money, but because it offers more resources and connections.”

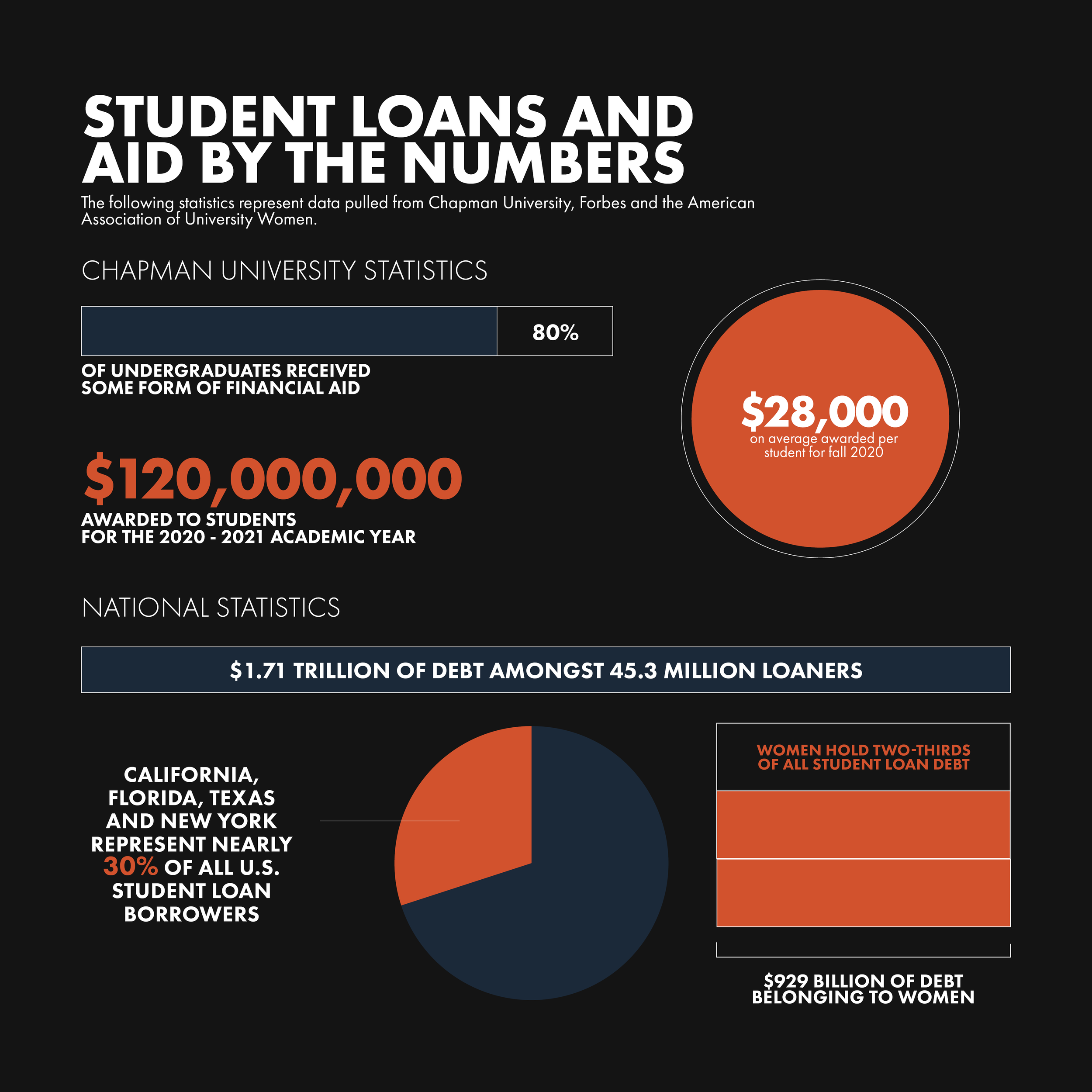

Ramirez’s story mirrors that of millions of college students in the United States. In fact, there are currently 45 million borrowers in the country who cumulatively owe approximately $1.7 trillion in student loans. California, Florida, Texas and New York represent 30% of all U.S. student loan borrowers.

President Joe Biden said in a Feb. 16 CNN town hall that he supports making community college free for all Americans and making four-year public universities free for families making less than $125,000 a year. However, he does not support forgiving student loans for students who attend private “elite” universities, such as Harvard University and Yale University. Students who attend Ivy League schools represent less than 0.5% of the 15 million undergraduates in the United States.

While higher income individuals are more likely to have student debt, students from higher income households are more likely to attend college in the first place. However, Jenisty Colon, a first-generation student and junior communication studies and English double major at Chapman, feels that there is a misconception that those who attend a private university are all wealthy and privileged.

“There is this perception of, ‘Oh, you're rich because you go to a private university,’ but they don't know the loans that I'm taking out or how hard I work for scholarships,” Colon said. “There is a stigma … We should fix that somehow.”

Progressives within the Democratic Party, such as Rep. Alexandria Ocasio-Cortez (D-NY), have pushed back against the notion that the type of university someone attends or their socioeconomic status should determine whether or not they are eligible for student loan forgiveness.

“Who cares what school someone went to,” Ocasio-Cortez tweeted Feb 16. “Entire generations of working class kids were encouraged to go into more debt under the guise of elitism. This is wrong."

Biden has also received pressure to forgive a larger amount of student loans. Senate Majority Leader Chuck Schumer (D-NY), Rep. Ayanna Pressley (D-MA) and Sen. Elizabeth Warren (D-MA) have called on Biden to forgive $50,000 in student loans for borrowers, as opposed to Biden’s plan of forgiving up to $10,000. Biden firmly asserts he will not consider the $50,000 proposal.

However, advocates say a larger loan forgiveness would address racial and gender wealth gaps and further reduce the financial stress on borrowers. According to data from EducationData.org, Black and African American college graduates owe an average of $25,000 more in student loan debt than white college graduates. Approximately $929 billion in student loans belong to women, who hold two-thirds of all student loan debt, according to the American Association of University Women.

This past year, Chapman offered $120 million worth of financial aid to students, with 80% of undergraduates receiving some form of aid. The average award for the fall 2020 semester was $28,000 per student. Colon also credits the Promising Futures program and the Marian Wright Edelman First Generation Endowed Scholarship as significant sources of career development and financial relief for first-generation students.

David Carnevale, Chapman’s director of Undergraduate Financial Aid, told The Panther that Chapman hosts federal student loan counseling sessions to explain the rights and responsibilities of students both entering and graduating from Chapman. The Office of Financial Aid also works with professors to hold workshops about student loan payment strategies, which welcomes students who struggle to navigate student loans to meet one-on-one with an adviser.

Azucena Rodriguez-Baltazar, a first-generation Chapman alumna in the class of 2020, told The Panther that she spent every semester as an undergraduate working as a full-time employee — first starting at a McDonald's on West Chapman Avenue in Orange her freshman year. She and Ramirez both told The Panther that tuition was a steep price to pay on its own without any financial support. Chapman currently labels its full-time undergraduate tuition at about $56,830 for the 2020-2021 academic school year. This does not include additional fees such as room and board, student health insurance and other associated student costs.

“Honestly, if it wasn't for ... the amount of financial aid I received, I probably wouldn’t have gone (to Chapman),” Rodriguez-Baltazar said. “I probably would have gone to a different school."